SMSF loans

Self Managed Superannuation Funding – SMSF Loans

eFinance Home Loans specializes in SMSF Limited Recourse Borrowing Arrangements. We will help you choose a loan which is ‘suitable’ to your needs and provide you with the comprehensive information on a broad range of financiers and products. Once you have chosen a suitable loan from our panel of lenders, eFinance Home Loans will assist with all the aspects of obtaining the loan approval. We understand the speed and delivery are the most crucial part of the loan process, therefore we make sure that our turnaround times are measured in weeks, not months like other service providers. eFinance Home Loans deals with specialist LRBA lenders and by having direct contact with the loan assessment and decision-making team, we always know the very latest status of the files, making sure your settlement deadline is met.

SMSF and Limited Recourse Borrowing Arrangements (LRBA) Since the ATO final ruling, issued in May 2012, relating to “Self-Managed Superannuation Funds: Limited Recourse Borrowing Arrangements” the topic has become a point of considerable interest among SMSF Trustees wishing to diversify their investments. The final ruling presents an opportunity for SMSF’s to invest in direct properties utilizing the borrowing arrangement but it also comes with the critical issue of insuring all the SMSF compliance requirements are met.

Offering SMSF lending and making sure the SMSF trust deeds include LRBA’s, given eFinance Home Loans specializes in SMSF lending, provides the SMSF expertise gained in servicing SMSF’s in the capacity of working with SMSF accountants, auditors and tax agents. The mortgage broking and loan expertise provides unique and unmatched new service in the market with obvious and substantial advantages.

How a complying SMSF loan works:

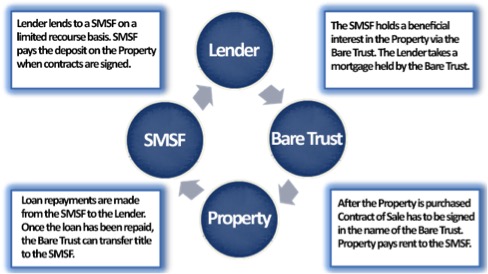

How a complying SMSF loan works: Case study scenario: SMSF wants to buy a property (residential or commercial real estate) but does not have enough funds for the full purchase. The SMSF can now make an equity contribution on the property and borrow the remainder of the funds to complete the purchase. The following diagram illustrates the process:

SMSF Financial position: The SMSF has two members and is in the accumulation mode. The fund holds $250,000 in cash and $150,000 in other assets. Being in the accumulation mode fund receives various types of superannuation contributions for its two members. The fund has also investments in equities from which it receives dividends. After talking to their Financial Planner and Legal advisor and reviewing the investment strategy, the trustees decide to diversify their portfolio by buying an investment residential property for $600,000. The advisor explained to the trustees that they can borrow, depending on the lender, up to 75% of the property value and up to 50% of the land value. This means that the SMSF would need to pay up to $150,000 deposit and obtain a loan for $450,000 representing 75% of the property value, using a limited recourse borrowing arrangements. The remaining funds to complete the purchase, transaction costs (stamp duty etc.) are paid from the fund’s reserves at settlement. The advisor also explained that because the loan is a limited recourse loan in the event of a default, the lender has recourse to the property security and any additional security provided by guarantors. All other assets in the fund will be protected from the lender. After the purchase and settlement, the trustees arrange for the property to be leased to an unrelated party and the rent, together with other SMSF income and/or member contributions are used to make loan repayments to the lender. Once the loan is paid off, the legal ownership of the property can be transferred to the SMSF.

SMSF Loans Features and Benefits

- Investment in property must be consistent with the SMSF Investment Strategy and Statement of Advice.

- The fund’s Trust Deed must allow borrowing.

- The SMSF must purchase residential or commercial property from an unrelated party at an arms-length transaction.

- If the property is a commercial property, then the SMSF can purchase the property from a related or non-related party, at market value and at arms-length.

- The SMSF loan is limited recourse which means that in the event of a loan default the lender only has recourse to the security property and any additional security provided by the guarantors but cannot claim any other SMSF assets.

- The security property is held in bare trust for the SMSF. The bare trust trustee must not be the trustee of the SMSF.

- The titleholder (legal owner) of the security property is the bare trust and the beneficial owner of the real estate will be the SMSF

- SMSF makes the loan repayments. After the loan is repaid the legal ownership of the property is transferred to the SMSF

- Generally acceptable security includes metro real estate in most capital cities, including residential, and non-specialised commercial property. The property size must be a minimum of 50 square meters!

- SMSF’s can deal with the property in the same way investors can deal with “normal” investment properties (i.e. they can lease, renovate, repair, or sell the property, subject to the terms of the relevant loan and mortgage) but they are not allowed to improve the property.

- All rents are paid directly to the SMSF. Loan repayments are made in the ordinary way from the SMSF.

- The SMSF can pay out or reduce the mortgage at any time (subject to the terms of the relevant loan)

- The SMSF receives all income and capital growth even if the property has not been paid off. The SMSF can use any income including income from the property to help pay off the loan

- Interest expense may be claimed as tax deductions by the SMSF and potentially reduce the SMSF’s tax liability.

What happens next:

- Upon the receipt of your “Free Preliminary SMSF Loan Assessment Form”you will be advised whether your fund is viable for the borrowing scheme

- You will receive the Credit Guide and if we are able to allocate a suitable lender for your requirement lender’s terms and conditions, including lender’s fees

- If you are successful with the first step you will be asked to supply additional information to enable us to process the assessment. You will also receive our Credit Quote & Proposal paperwork.

- If you are unsuccessful with the first step we will contact you and explain your options (if any) to satisfy the lending criteria.

Please note the minimum loan amount is $100K for residential or commercial SMSF loans.

Upon your acceptance of our Credit Quote & Proposal for your SMSF investment property finance application, you will receive an invoice for a payable commitment fee which includes initial interview with the borrower making sure that the loan is suitable, collection and verification of all the documentation relevant for the procurement of the loan and liaising with the lenders until all the documentation is successfully processed and the loan is approved. Various additional costs apply associated with the loan procurement, such as lender’s fees starting with the application fee, legal fees, valuation fees, settlement and stamp duty fees. All the fees are summarizes in the Credit Quote & Proposal documentation. Current rates should be used as a guide only and can change without notice.

Interest rates and application fees relating to the SMSF property loans are higher than for the regular mortgages, and here are the main reasons:

- complexity of the SMSF compliance and legislation resulting in the involvement of specialized resources

- increased amount of the supporting documentation

- longer due diligence process

- higher risk of the lenders associated with the Limited Recourse Borrowing Arrangements concept

SMSF Loan Process

- Get Professional Advice Obtain professional advice from an Australian Financial Services Licence (AFSL) holder if considering whether to establish your SMSF and or borrowing through your SMSF is an appropriate investment strategy for your SMSF.

- Establish your SMSF The SMSF Trust Deed must have the clause giving the Superannuation Fund Trustee power to:

- purchase real estate,

- borrow money, and

- mortgage property to secure repayment of that borrowing.

- Enquiry with one of our eFinance Home Loans Consultants about the costs and fees for establishing a SMSF ?

The proposed investment must comply with the requirements of the Superannuation Industry Supervision Act 1993 (SIS Act) and ensure that the investment in real property is in line with the SMSF’s overall investment strategy, and the proposed purchase complies with all other requirements of the SIS Act (including but not limited to the “in-house asset rules” and the restrictions on acquiring assets from “related parties”). It is important at this stage to verify the available equity in your SMSF as this will affect the ultimate purchase price of the property your fund can acquire. Submit the Trust Deed to the State Revenue Office for a payment of stamp duty if applicable.

- Obtain Loan Pre-Approval Obtain lender’s pre-approval prior to signing the real estate purchase contract and paying deposit monies. There is no point in establishing a Custodian Property Trust before the loan pre-approval is granted.

- Establish the Custodian Property Trust After the lender’s pre-approval is obtained you can setup the Custodian Property Trust Structure. N.B. The Custodian Property Trust is also called Holding or Bare Trust. The Custodian Property Trust Deed sets out the relationship between the custodian who acquires the property as trustee for the superannuation fund and gives a mortgage over the property to the lender, and the trustee(s) for the superannuation fund who will borrow under the loan agreement to fund the purchase of the property by the custodian. The Custodian Property Trust must have a company as a trustee. That company cannot be the same company as the company that acts as trustee for the SMSF. Directors of the Custodian Property Trust Company must be the trustees of the SMSF if the fund has individual trustees, or directors of the trustee company of the SMSF.

- Signing of the Custodian Property Trust Depending on a lender, signing of the Custodian Property Trust Deed must be done before exchange of contracts for some lenders and after the exchange of contracts for other lenders.

- Purchase Contract can be formalised When contracts are exchanged, subject to finance, between the seller as vendor and the Custodian Property Trust as purchaser, the deposit will be paid by the SMSF. The purchase contract must be signed in the name of the Custodian Property Trustee and not in the name of the SMSF or trustees/members.

- Stamping of the Custodian Property Trust Submit the Custodian Property Trust Deed to the State Revenue Office for a payment of stamp duty if applicable, different states attract different fees.

- Valuation Ordered & Formal Loan Approval Once you have signed the purchase contract and returned the documentation to an eFinance Home Loans, the lender will order the valuation. Once all the lender’s conditions are satisfied, formal approval for your SMSF loan will be issued.

- Lenders Solicitors prepare & issue Mortgage Documents The lender will instruct solicitors to prepare your mortgage documents and they will be presented to you for signing. The SMSF borrowing structure uses normal loan and mortgage documents with special provisions to provide the limited recourse against the property being purchased.

- Settlement The purchase is completed after registration of the transfer on the mortgage to the Trustee of Custodian Property Trust. This will be arranged by your solicitor.

- Investment Property Income and Expenses The property rent is paid directly into the fund’s SMSF bank account as well as loan repayments and other property expenses.

- Loan Serviceability and Loan Protection Insurance Self-Managed Superannuation Fund Trustees have the responsibility of considering and incorporating the life insurance for the members in the fund’s Investment strategy. The legislation however does not stipulate the level of the insurance coverage for the SMSF members, given the possibility of the members having an appropriate life insurance level outside the SMSF. SMSFs LRBA also require review and implementation of the insurance strategy. The need for the insurance arises from the ever-changing life events that can impact the loan repayments. The life events dictating such a need are anything from loss of employment, serious injury, illness or death. An appropriate insurance strategy will ensure the loan repayments are met. Note: the insurance policy must be in the name of SMSF with member/members named as the insured person/s.

- Loan Repaid When the investment property loan is eventually repaid, trustee of the Custodian Property Trust should transfer the asset from the Custodian Property Trust to the SMSF.

The Advantages of having a Mortgage Broker: Buying a property is a complex and potentially stressful experience. Appointing an eFinance Home Loans Mortgage Broker will ensure the proper ground work has been done, and the selection of the best lender and the most suitable deal is in place.

Limited Recourse Borrowing Arrangements available to SMSF’s are complex due to the specific requirements, legislative issues and lender limitations imposed on this type of loans. eFinance Home Loans expertise in the field of SMSF compliance documentation review and structure partners together with any accounting firms and financial planners in accounting, taxation, audit and regulatory reporting.

With the solid understanding of the legal and compliance documentation associated with the SMSF loans and the knowledge of the lending markets, eFinance Home Loans provides the quickest and most cost-efficient loan solutions.

We recommend that you have an initial consultation with us before you start looking for a property to get a rough idea of how much you will be able to borrow, whether the investment property address postcode is acceptable to the lenders, and more importantly, whether your SMSF structure and current Trust Deed allows LRBA.

The critical factors deciding how much money your SMSF can borrow and whether you are going to be able to service/repay the loan are:

- SMSF current assets value,

- Annual guaranteed superannuation contributions into the SMSF (your employer’s contributions) , and

- The investment property rent.

The lenders will provide loans of up to 80% of the investment property value and give you an option of selecting a type of interest rate, whether it is fixed or variable. eFinance Home Loans provides mortgage broking services on the assumption that you have obtained advice from a licenced financial planner in relation to the investing of your SMSF funds in real estate property or eFinance Home Loans can direct you to any such qualified advisers at via eFinance Wealth.

LRBA Background Generally, subject to limited exceptions allowed under the Superannuation Industry (Supervision) Act 1993 (SISA) Self-Managed Superannuation Funds (SMSF’s) are prohibited from borrowing money. In September 2007 SISA was changed to allow SMSF’s to invest in certain limited recourse borrowing arrangements via borrowing money to acquire a permitted asset. At the time, the ATO was concerned about the scheme because of emerging higher risk and superannuation planning issues, subsequently in July 2010 the laws have been amended to clarify and better specify the limited recourse borrowing arrangements by SMSF’s. The amendment has outlined the following requirements:

- Super fund assets are better protected in the event of a default on a borrowing

- The asset within the arrangement can only be replaced by a different asset in very limited circumstances specified by the law

- The borrowed monies are used to acquire a single asset, or a collection of identical assets, having the same market value (that are together treated as a single asset), which the fund is not otherwise prohibited from acquiring (called the ‘acquirable asset’). The new law makes it explicit that borrowed money applied to expenses incurred relating to the borrowing or acquisition (such as loan establishment costs or stamp duty), or expenses incurred in maintaining or repairing the acquirable asset, is allowed

- The borrowed monies are not applied to improving an acquirable asset

- The acquirable asset is held on trust (the holding trust) so that the SMSF trustee receives a beneficial interest in the asset

- The SMSF trustee has the right to acquire legal ownership of the acquirable asset by making one or more payments after acquiring the beneficial interest

- Any recourse that the lender or any other person has under the arrangement against the SMSF trustee is limited to rights relating to the acquirable asset. This limitation applies to rights directly or indirectly relating to a default on the borrowing and related charges or directly or indirectly relating to the SMSF trustee’s rights in respect of the acquirable asset (for example, rights to income from the asset)

- The acquirable asset is not subject to a charge other than as provided in relation to the borrowing by the SMSF trustee

In May 2012, the ATO released final ruling “Self-Managed Superannuation Funds: limited recourse borrowing arrangements – application of key concepts”. The final ruling provides greater investment opportunities because it allows investments in an older investment property that is in a need of renovation, and the renovation of the property can be done by using borrowed money under the existing LRBA. However, there is a caution in the ruling against the property improvements that cannot be performed by using borrowed money under the existing LRBA. The ruling provides vital definitions and key concepts explained by examples and it’s the must read for trustees thinking about LRBA.

For any questions or enquiries about the above, please feel free to contact us. Click Here